What Is Verified TransferWise Accounts?

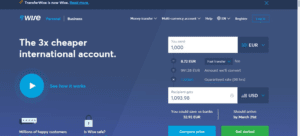

Buy Verified TransferWise Account. In today world TransferWise is an increasingly popular online money transaction service that permits users to send money quickly, safely. And at a fraction of the cost of traditionary banking services. One way of ensuring the safely of money transfers is through the use of 100% verified TransferWise accounts. Verification TransferWise accounts give users added assurances that. The transactions are safe and 100% legitimate. In this blog post, we will have discuss to do with what TransferWise Accounts are. How do they trade, How they work, and the convenience they provide users. We’ll also explore the steps to Verified a TransferWise account. With all the information available, you can make an aware of decision about whether A transferwise accounts are right for you.

It is very secure to use to send and receive money from overseas. Wise (formerly known as TransferWise) is a money transfer services send and receive money from millions of clients worldwide. They offer close to mid-market exchange rates with a transparent fee structure. You can send or receive money from a bank account in most countries almost the globe. Whether you send money through their Borderless accounts or multi-currency account, your money is safe.

How does TransferWise work?

When you want to send money abroad with TransferWise it feels like the money is going outright from your bank account into your recipient’s account. In fact, there is more going on behind the scenes. TransferWise has accounts all over the world. Then the TransferWise account in the foreigner country you want to send money to will send the local currency to the recipient. The money you transaction doesn’t actually cross the border.

For example, imagine you are sending money from the United Kingdom to family in the United State. You would log in to your TransferWise account and link it with your British bank account, you would also enter your United State recipient’s bank details. It’s just like setting up a new payee on your bank account. When ready, TransferWise will transfer the requested amount of British pounds (£ GBP) into their own United Kingdom account. Wise would then alert its United State account, which would then send the agreed amount of United State dollars ($ USD) to the recipient. The company makes its profit through fees on these trading, which are expressly calculated upfront before any commitments are made. You can even use their transformer on their home page before register.

TransferWise features

Competitive, transparent money transaction

International money transaction have always been the headline sufficiency of TransferWise, or Wise. It is not the only company to offer these services, but as a long-time user, I can certified that their platform is significantly simple, easy to use and their rates have always strong me as both reasonable and transparent. That’s no accident. TransferWise takes pride in offering a seamless user experience. It boasts that it is 13 times cheaper than traditionary exchange services. In combination, it’s no wonder it’s grown in international popularity – and has become one of the world’s most valuable financial technology startups.

Currently, users can transaction money in their local currency or over 50 various currencies. To be precise, TransferWise supports customers to send and receive money from a list of 22 currencies. And customers can send money (no receiving) in another 27 currencies via local transaction. The company prides itself on no hidden fees and complete transparency. While various transactions in various currencies will have various fees, this can be easily checked on the homepage or whenever you make a transaction as the fees will be clearly shown upfront.

When you want to transfer your money or pay someone, they will clearly tell you how much you have been charged for the transaction. They also lock in the exchange rate they have suggest before you hit send so the rate doesn’t go up before your money reaches them. They call it ‘Guaranteed Rate’.

Multi-currency accounts

The recent name change to TransferWise reflects that the company now offers much more than transaction. International accounts are now their main item offering – and that’s exciting news for everyone with international networks and reproduction. Many of us now live, work and travel around the world, or simply have friends and family who do. However Bank accounts generally don’t, and are compressed by geographic boundaries, making some financial interactions awkward and expensive.

TransferWise multi-currency account is heaven-sent in this regard, because for most of us with fairly straightforward international transaction require, this account makes all those hurdles problems of the past. TransferWise multi-currency account (which called TransferWise Borderless Account) is a lot like having multiple bank accounts abroad. It allows users to hold money in more than 50 currencies. As an example, let’s say you have British pounds (GBP), United States (USD) euros (EUR) and Australian dollars (AUD) in your TransferWise account. If you want to transaction money to a euro account, Wise will use your euro balance automatically. If you are transferring more euro than you have, TransferWise will automatically convert some of your other currency to cover the distinction.

Then let’s say you’re receiving paid from an Australian bank account, you can view your unique AUD account details on Wise so you can get paid in AUD. Just like you had a bank account in all those various countries. If you are finding one of your balances too low, you can always conversion one of the other currencies you have in Wise or you can easy transaction money into your Wise account from a credit card, debit card or by bank transaction or Swift transfer. With TransferWise you can view your money, and spend money through both the desktop version and the mobile app version. You can also withdraw currencies from ATMs but it’s good to check the local charges depending on where you are.

Personal account

Let’s say you have a family member in the United States, and they want to send you money. With your TransferWise account, you’ll just need to share your USD account details with them. They will be able to send USD immediately to your USD balance using that account details.

Business account

Let’s say you’re a company with one customer in the United Kingdom and one in the United State. You can open both USD and GBP account details in your Wise account to make payments in both currencies. All you have to do is share your USD account details with your United State customer and your GBP account details with your United Kingdom customers — now they can send you money in those currencies.

Is TransferWise Safe?

Of course, 100% TransferWise is a safe and proven method of transferring money abroad between currencies. It has an excellent 9.5 out of 10 rating on TransferWise. Most negative Transferwire Account are related to business Verified or the 24-hour limit, but there are no reports of lost or hack money. The security advantage of TransferWise comes from the peer-to-peer method. As mentioned, your money goes into one pot and the transformed money is taken from the other pot. This method assures that your money is safe and conserved, since it isn’t moving across borders. Banks still use a one-pot method.

TransferWise reviews, by customers and professionals alike, are generally positive. There are very few complaints about Verified TransferWise. It seems to be the safest service to transaction money overseas currently on the market, with thousands of satisfied customers. It is possibly secure than transferring your money overseas through a bank, and definitely secure than transferring through other money transfer services with lower ratings.

What is Wise used for?

Anytime you want to transaction money internationally, Wise is one of the excellent solutions. You can use it to send money to someone else, or even your own other account in another country. Wise began at its headquarters in London back in 2011, Currently there are offices all over the world. A cross-border transaction made through Wise feels incredibly easy for the user, but there’s actually quite a bit going on behind the scenes to make it work.

Wise has various accounts in various countries, so when you make a wire transaction you send it to one of these accounts. Verified Wise will then transfer the same amount from one of their other accounts in the recipient’s country to the intended account. For example, if you’re sending money from the United States to Australia, you’ll send money from your United States bank account to an account held by Wise in the United States. They will then send money from an Australian account which they then deposit into the recipient’s Australian account.

What Is the Business TransferWise Account Benefits?

The great thing about a TransferWise Business account is that you can use it just like a bank account in many cases; such as making payments to other business accounts and receiving payments from customers using the unique account details associated with your multi-currency account.

The main benefit of using a Verified TransferWise Business account over traditional overseas bank accounts is that you won’t be charged international transaction fees for receiving that currency, or inflated exchange rates when you require to convert the money. This is extremely convenient for those who need access to international business account details as non-residents of that country. You can open an Wise account online a few minutes. They also offer a debit Mastercard for business customers resident in the United Kingdom, United States, Europe, Australia, Singapore, New Zealand and Japan so you can spend money at the mid-market exchange rate and enjoy low alternative fees all over the world.

Conclusion

TransferWise Wise is a secure currency exchange and international transfer provider, which is popular thanks to its convenient service and low overall transfer fees. Wise has a number of features to keep client money secure, including detailed account Verified, 2 factor identification for accounts and card use, and 24/7 anti fraud controls. Like banks and most other financial service providers in the United Kingdom and United States, TransferWise is registered with FINCEN and regulated by global regulatory bodies everywhere services are offered.

Again, we want to assure you, Buy Top Service is one of the best quality, reliable TransferWise Account Services Provider. We are providing the Best Quality TransferWise Account at the cheapest rate. Along with we give 100% money-back guarantee. Our only demand is to gain clients satisfaction through good and reliable services. So, you can Buy TransferWise Account from here without any type of hesitation. Buy Verified TransferWise Accounts.

Reviews

There are no reviews yet.